Account Reconciliations are a key step to the financial close process. At its most basic, an Account Reconciliation can be defined as:

The ability to substantiate an account balance using independent means to validate the accuracy of transaction inflows and outflows to ensure that the ending balance is what it should be.

Reconciliations have been a part of business from the beginning of time. Validating balances and transactions is part of daily operations. For example, if you sell a glass of lemonade for $1, it is easy to ensure that you receive the $1 at the time of the transaction. However, if the lemonade stand is open and happens to be set up on a running path with hundreds of runners stopping for lemonade, now the flow of transactions becomes very rapid. The exchange of product for money is happening at a pace that is very difficult to keep track of. What does the lemonade stand owner do at the end of the day? They reconcile the cash in the till to the glasses of lemonade sold, to ensure that all the cash was received, aka an Account Reconciliation.

Expand that example to today’s world with global organizations that employ thousands of employees, transacting in many currencies, purchasing significant materials, selling a multitude of products, and it starts to become complicated and difficult to manage. How do we ensure the financial balances are complete and accurate? How do we make sure errors are not being made that have a material financial impact? How do we fend off theft or fraud? One way that organizations mitigate these potential issues is by performing Account Reconciliations.

Reconciliation Process

When performing Reconciliations, it is typically part of the organization’s month-end close process and is performed within the General Accounting and Shared Service departments. As mentioned, companies may choose to perform Reconciliations to mitigate risk, but they may also prepare Reconciliations to facilitate audit requests, statutory obligations, or the more prevalent requirement of Sarbanes-Oxley. The Reconciliation process is defined into three key areas:

- Preparation

- Review and sign-off

- Monitoring

Preparation

Preparing the Reconciliation is the process of analyzing the ending General Ledger balance at a point in time. Account Reconciliations are performed typically on Balance Sheet Accounts but can be done on any Account that is significant to the organization. The Reconciliation preparation for most organizations is a very manual process of gathering information, setting up workpapers, and then performing the analysis. Unfortunately, although the most important step is the analysis, Preparers spend significant time on the former.

The different types of Reconciliations that a User will prepare are broken down into the following categories:

- Cash – Bank, Investments, etc.

- Customer-Related – Account Receivables, Deferred Revenue, etc.

- Vendor-Related – Accounts Payables, Accruals, etc.

- Business Operations – Inventory, Fixed Assets, Intercompany, etc.

How the User analyzes the Account depends on the types of transactions flowing through it. Customer receivables are confirmed through analysis of the subledger, while Cash Accounts are mainly substantiated utilizing bank information. Reserve Accounts, meanwhile, are validated through calculation. Whatever the method, a good Reconciliation will include the General Ledger balance, detailed explanations, and all the analysis and support needed to substantiate the balance to within a threshold set by the organization’s accounting policies.

Review and Approve

Once a Reconciliation is prepared, the User must sign-off on the workpapers. In addition, every Reconciliation typically requires a review and approval process to validate the Preparer’s work. Depending on the importance of the Account, it may require multiple Approvers to reduce risk. For all roles, the sign-off process is the User attesting that they performed their responsibilities regarding the Reconciliation process in accordance with the organization’s policies.

Monitoring

Monitoring is the overarching control process to ensure that everything is being done as expected. This process helps to inform management of any identified issues or risks.

Monitoring includes:

- Ensuring all Reconciliations have been completed within the due date set.

- Sign-offs have been completed by the required roles.

- Newly-created General Ledger Accounts have been included in the Reconciliation process and properly assigned to End-Users to complete and review.

- Adjustments identified in the process have been escalated or corrected.

Manual Reconciliation Process

The process, as defined above, is typically manual in most organizations. Reconciliations are prepared in Excel in varying file formats, and the files are saved to shared folders or printed – depending on the requirements – with an overall Administrator tracking the process to ensure all the work has been done. Although the manual process has worked for many years, as companies grow and become more global with multiple financial systems, it is very difficult to ensure the accuracy, completeness, and validity of the work performed.

The typical issues we see prevalent in a manual process today are:

- Ensuring the General Ledger balances are accurate and up-to-date.

- All required Reconciliations for a specific period have been prepared.

- Any past due Reconciliations are identified.

- New Accounts are properly included in the process.

- Reconciliation explanations fully validate the General Ledger balances within the threshold set.

- Proper support has been attached.

- Identified open items that need correction are highlighted.

- Open items are properly aged.

In addition, a manual process is tedious from an approval perspective. Gathering Reconciliation approvals manually can be done in many ways. In some organizations, the Preparer would print the Reconciliation and walk it around for physical signatures. Others would leverage emails to document approvals. We have also seen Users copying a signature image into the Excel file, which requires someone opening the file to ensure sign-off. All of these methods are very time-consuming and prone to error.

Automating with OneStream

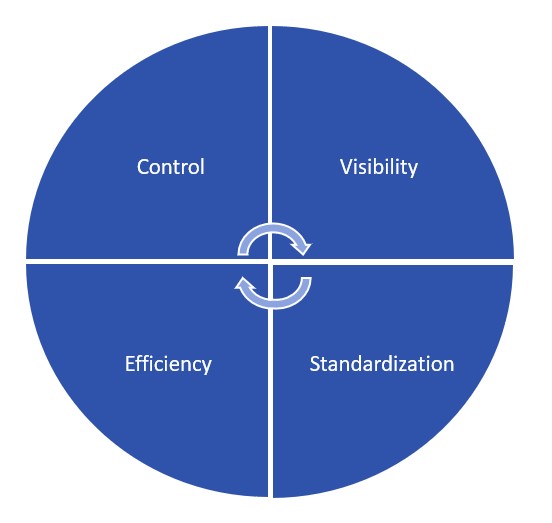

Moving your process to OneStream, and using the Financial Close solution, not only eliminates the concerns identified above, but also results in a more streamlined, automated solution, delivering the four key pillars of a good Reconciliation process:

- Visibility

- Standardization

- Efficiency

- Control

The following sub-sections highlight a few of the items that the solution delivers, relating to each of the key pillars.

Visibility

- Global repository for all Reconciliations and related support.

- Delivered Dashboards and scorecards to monitor the organization’s process for complete governance.

- Detail item classification; aging and reporting to escalate potential issues and risk.

- The ability to drill down from the consolidated financial statement balance to the underlying Reconciliations, to better understand the financial statement line item.

Standardization

- A Reconciliation template library with the ability to associate specific templates to specific Accounts to ensure standardization across the organization.

- The User Interface is consistent – regardless of the Reconciliation – for ease of preparation, review, and audit.

- The ability to assign risk, due dates, and frequencies to ensure Reconciliations are performed consistently.

- Item Type classifications are used to categorize open items across the organization.

- Rejection Reason Codes are employed to help identify why Reconciliations are sent back to the User.

Efficiency

- Leverages the trial balance loaded for Actuals to populate the two key processes – Consolidations and Reconciliations – ensuring that they are both in sync.

- Automatically creates the Reconciliation for the User, and populates it into the proper period based on the frequency set.

- Electronic Workflow routes the Reconciliation to the appropriate Users based on the number of required approvals, with email alerts if desired.

- An Auto Reconciliation process that systematically prepare or fully approve Reconciliations that meet specific rules, thus eliminating manual intervention.

- Identifies and creates Reconciliations for new Accounts created in the underlying General Ledger.

Control

- Balances are automatically updated with new trial balance loads, ensuring the Reconciliation is up-to-date.

- The segregation of duties is enforced, preventing Users from preparing and approving their own work.

- Thresholds are set to ensure Reconciliations are not prepared if not fully explained to within the threshold set.

- Reports are available to monitor the process and confirm Reconciliations are done within the due date set.

- Corrections are identified and aggregated to determine if there are any material corrections that need to be addressed.

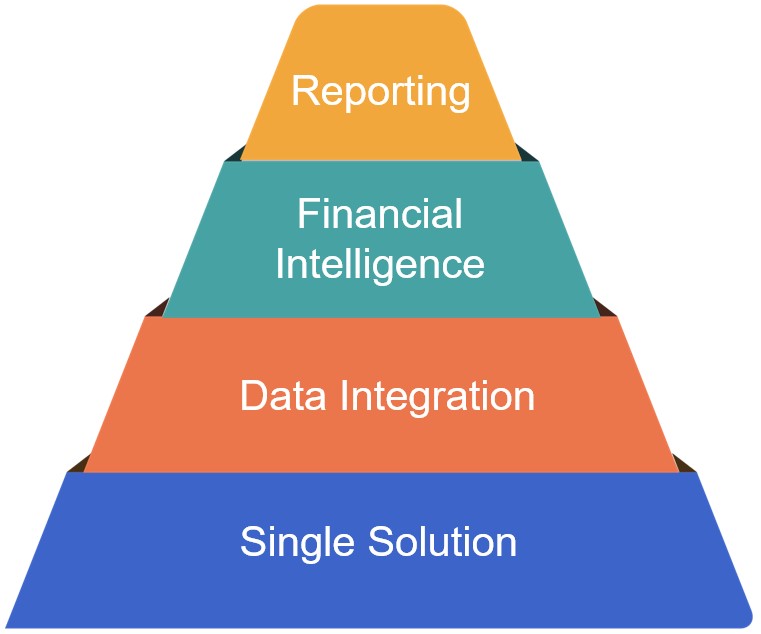

Next Level of Excellence

Utilizing OneStream’s Account Reconciliation Solution elevates the overall process. However, the OneStream application offers additional value that many may not be aware of, including:

- Single Solution

- Data Integration

- Financial Intelligence

- Reporting

* * * * *

This was an excerpt from Chapter 1 of the OneStream Financial Close Handbook.